The print industry is evolving fast, and 2025 is shaping up to be a big year for change. The print industry market is expected to grow from $339.57 billion in 2024 to $357.8 billion in 2025, with a steady increase of 5.4%.

In order to remain competitive, the printing industry, which has such a large volume, must keep pace with technological advancements. Further, it has become imperative to start utilizing digital technologies in the most effective manner possible to meet the needs of customers.

A 30-year veteran of the digital printing industry, Sean Marske will lead this interview about digitization in the printing industry.

Question: Could you please tell us about your background and experience in the printing industry?

I work independently as a consultant. Regardless of the size and industry of the company, I guide them through the process of implementing an electronic package printing solution that is profitable and successful. A professional and entrepreneur with over 30 years of experience in digital printing technologies, products, and applications, I am an expert in digital printing technologies.

Question: What is one key strategy that has helped print shops grow their business post-COVID-19? What advice would you give for achieving exponential growth in the next five years?

I have observed that Print Service Providers (PSPs) who undertook a proactive strategy of diversification into segments outside of their traditional, primary market base have achieved bottom-line growth in the post-pandemic landscape.

The General-Commercial PSP space was particularly hard-hit during the Covid-19 economic contraction. The Printed Packaging segment was less impacted, and even grew in some application areas such as labels and corrugated.

Consequently, PSPs that invested and expanded their capabilities into package printing are now beginning to realize growth in profits, revenues, or both.

The growth of digital package printing globally is undeniable and accelerating. While digital label printing is the clear leader in the accelerating digital packaging transformation trend, the digital printing adoption within the folding carton, corrugated and flexible packaging segments are gaining industry investment and PSP budget allocations respectively.

Printing companies that diversify into or continue to increase their digital package printing expertise will realize the highest probability to remain competitive and experience profitable growth over the next 5 years.

Question: How can print businesses identify and maximize the strengths of digital printing to scale their operations?

The most straightforward method for identifying opportunities for digital printing is through a focused analysis of both production and customer data.

More specifically, this means establishing clear metrics that measure and chart trends in customer purchases, print run profitability and job quotation won/lost ratios.

While every print business has its own DNA and customer mix, understanding these key trends can help pinpoint where a digital printing solution may be justified (or not).

For example, if there’s a downward trend in print run profitability due to setup cost absorption vs. a winning sell price; digital printing may lower setup costs and increase profits.

Similarly, if there’s an increasing trend in customers breaking traditional order volumes up into additional copy or profile changes, digital printing/finishing may significantly reduce or eliminate costly press changeover stoppage.

A trend where job quotes being lost (versus won) on price are increasing over time, indicates that the price-winning competitor likely has a digital printing solution.

Understanding these trends can certainly serve to highlight digital printing’s value as an additional tool in the overall operation, however, true leveraging of Digital strength will be realized by Print Service Providers that adopt and execute a “Digital Mindset” throughout their organization.

Embracing a Digital Mindset creates a Print Buyer experience offering minimal touch points and maximum flexibility across the design, material selection, embellishment, finishing, pricing, proofing and order fulfilment workflow.

In my opinion, the largest opportunity to leverage such a digital strength is in the packaging space.

No more manual artwork file reviews—our preflight system detects issues before they become problems.

Question: With the rising demand for short-run jobs, how can print service providers turn this into a profitable opportunity? Which technologies can simplify the process?

I recently challenged the validity of the term “short run” in the digital printing landscape.

The fact is, as digital technologies continue to improve in both throughput, print quality and flexibility, what was considered a short run quantity a few years ago has changed significantly as digital’s ability to cost-effectively produce more for less increases.

In general, print volume demand is increasing in most market segments while variation and versioning are concurrently increasing also.

Digital offers the ability to deliver substantial flexibility, in highly variable quantities with consistent pricing (regardless of quantity) and very fast order fulfillment.

The key technologies that will catalyze higher profit opportunities for PSPs are digital direct-to-product printing (inkjet), embellishment, and toolless cutting/finishing systems.

Embossing, metallic decoration, variable cutting/scoring/perforating and automated job nesting are driving efficiency and simplifying workflow management.

Question: What are your thoughts on automation through web-to-print solutions in the print and packaging industry?

Web-to-print is a perfect example of what’s helping drive the Digital Mindset I mentioned earlier.

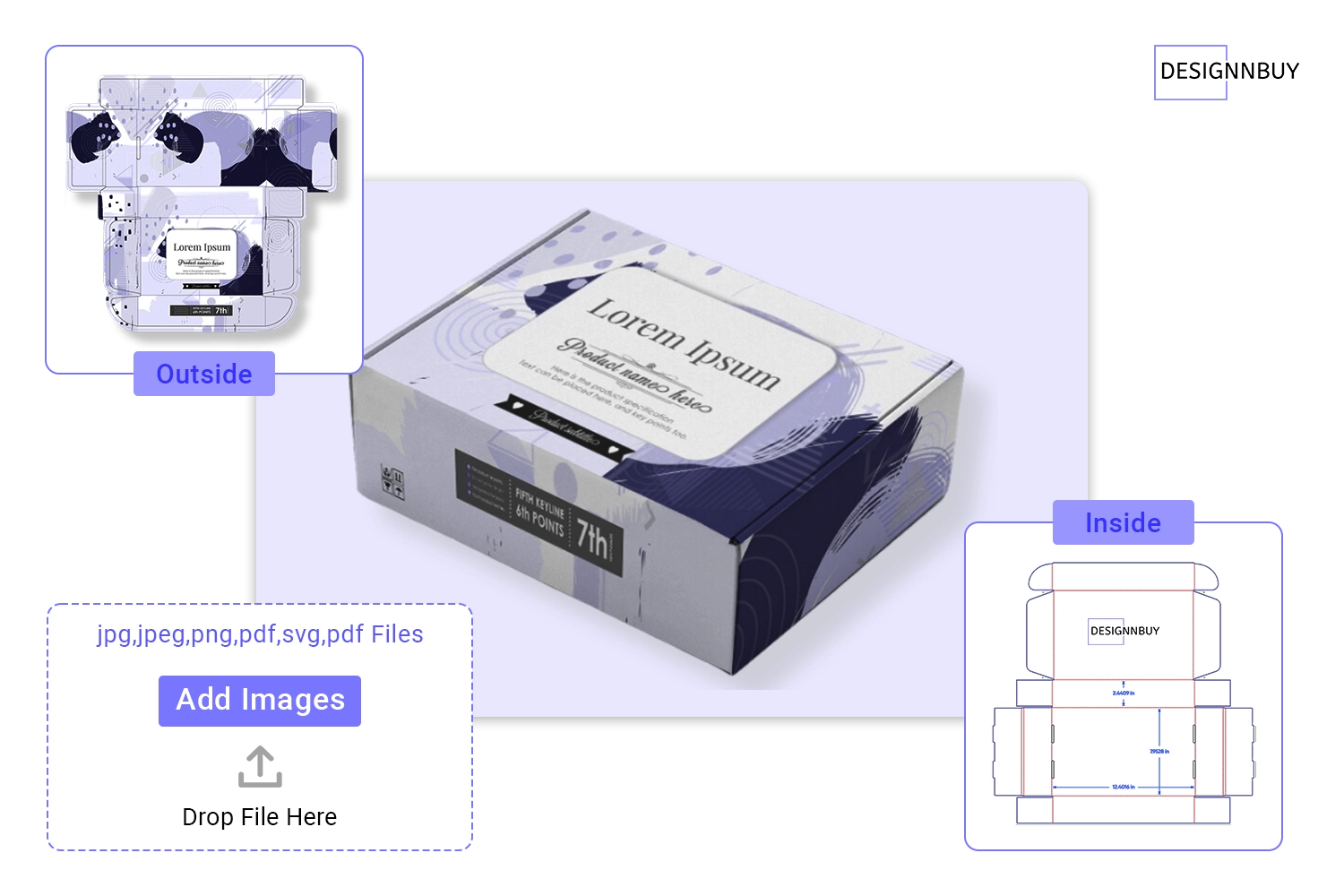

Enabling a Print Buyer to conceptualize, design and visualize (digital proof) a project online creates a powerful Digital Experience.

This technology will have the biggest impact on the packaging industry in my opinion. As this practice gains momentum and adoption, Print Buyers will increasingly expect this level of capability and service throughout the industry.

The challenge for software developers will be to integrate shop floor equipment profiling to automate the pre-press, validation and production workflow to reduce as many touchpoints as possible. This is already happening.

One gating factor to the growth of web-to-print could be material and substrate selection. Today there are thousands of such options in the market.

PSPs would do well to focus and limit these options based on market segments they target.

Attempting to be many things to many customers risks diluting resources and capital while increasing inventories and supply chain complexity.

Let customers visualize their packaging in 3D before printing. Try our 3d packaging design software now!

Closing Thoughts: The Future of Digital Package Printing

It is imperative that print shops improve their processes in order to remain competitive in the future. Digital and automated processes enable them to handle short runs profitably and respond to customer requests flexibly. Thank you so much for talking to us, Mr Marske!

Bringing it all together :

The following interview is one of a series. Stay tuned to our blog to see more interviews with industry thought leaders. To learn more about our web-to-print solution, please fill out the contact form, and a member of our staff will contact you shortly.

AI and Automation Matter for Print Businesses

Would you like to explore AI-powered web2print solutions tailored to your business needs?

*This post has been updated on Mar 2025.